What Financial Services Does Diamond Property Finance Offer In 2026?

When Rehan’s remortgage window landed at the same time as a time-sensitive investment purchase, he quickly discovered what many UK borrowers are learning heading into...

Finding The Right Diamond Property Finance Services For Your Property Plan In 2026

When Leanne’s onward purchase slipped by three weeks, she suddenly had two competing pressures: keep the seller on-side and keep her own monthly costs sensible when...

Are Boutique Property Lenders a Better Choice for Complex Loans?

When Aaron won a mixed-use lot at auction, he faced three hard constraints: a 20-day completion window, a layered income profile (director dividends + rental), and a...

Comparing Diamond Property-Linked Lenders vs High Street Banks for Finance

Here’s a scenario: when Nisha’s auction bid was accepted, she had 20 working days to complete and an onward plan to refinance. In 2025, timelines like this are common...

Exploring Specialist Finance Products at Diamond Property Finance

When Amar, a UK-based portfolio landlord, won a mixed-use deal at auction, he had 20 working days to complete, tidy a historic tax issue and line up a longer-term...

How Diamond Property Finance Supports UK Property Developers and Investors

When Priya, a London-based investor, spotted a mixed-use block with a 30-day completion window, she knew speed alone wouldn’t cut it; she needed the right structure to...

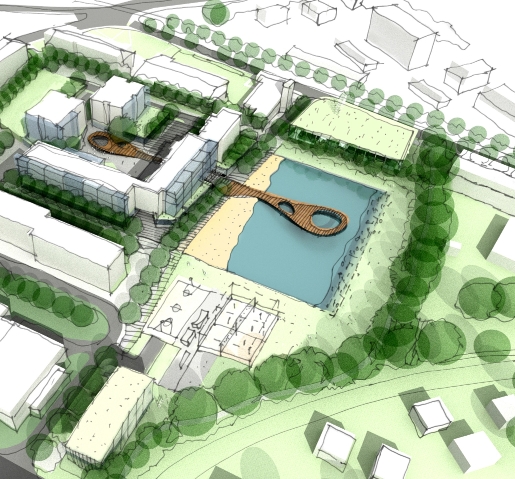

UK Property Development Finance: Everything You Need to Know in 2025

Property development remains one of the most lucrative sectors within the UK property market, yet securing appropriate financing continues to challenge even experienced...

Property Finance Broker Explained: Why It Pays to Use a Specialist in 2025

The UK property market in 2025 presents both unprecedented opportunities and complex challenges for investors and homebuyers alike. With interest rates fluctuating,...

Why Do Mortgage Applications Get Declined? Common Mistakes and How To Fix Them

Whether you’re a first-time-buyer or home mover, navigating mortgages can feel tricky. Before starting your journey to property-ownership, it’s important to understand...

How to Get a Mortgage with A Low Credit Score

Securing a mortgage can seem challenging, especially if you have a low credit score. Many people think that a low credit score means they can't get a mortgage at all,...

Short-Term Bridging Loans vs. Property Development Loans: Which One Do You Need?

When navigating the UK property market, developers and investors face a crucial decision: choosing the right financing solution for their projects. Two popular options...

Things to Consider When Reviewing A Mortgage in 2025

With the new year upon us, many clients find themselves assessing the prospect of home buying or remortgaging over the next 12 months. In this article, Diamond Property...

How to Secure a High Net Worth Mortgage with Complex Income

Securing a mortgage as a high-net-worth individual can be surprisingly challenging, especially if your income doesn’t fit the ‘predictable’ patterns that mainstream...

High Net Worth (HNW) Mortgages for Prime Property Buyers

The UK's prime property market requires sophisticated financing solutions that extend far beyond conventional mortgage products. High net worth individuals (HNWIs)...

Overseas Mortgages Made Easy: How to Buy UK Property from Abroad

The UK property market remains one of the world's most attractive investment destinations for international buyers seeking stable returns, capital growth, and portfolio...

Bridging Finance vs. Traditional Loans: Which is Right for Your Property Investment?

In the fast-moving world of UK property, timing is everything. Whether you’re a seasoned investor or just starting out, the ability to move quickly can mean the...

Fixed-Rate vs. Variable-Rate Mortgages: Which One is Right for You?

Navigating the mortgage market can be confusing, especially when it comes to knowing which type of mortgage is best for you. One key decision is to choose between a...

How Much Can I Borrow for a Mortgage? Understanding Affordability

When you explore buying a home, the first thing you need to do is check your finances. When it’s time to apply for a mortgage, one of the first steps in a good...

Offshore Mortgages for UK Property: A Guide for International Buyers

The UK property market continues to attract international investors and buyers seeking stable returns, capital appreciation, and lifestyle opportunities. However,...

Mastering Mortgages: Demystifying Application Fees

We know the mortgage landscape can be tricky, that's why the team at Diamond Property Finance are on hand to help. There are many different fees to consider which can...